A brief history lesson

The concept of a ground lease is quite old. In fact, the history of ground leases can be traced back almost 1,000 years to the feudal traditions of England. To this day, the British monarchy controls a multi-billion dollar leased portfolio. We too, in the United States, have a history of ground leases stretching back several hundred years. In older cities, such as New York, organizations such as Trinity Church or families like the Appleby’s have utilized ground leases to build multi-generational wealth.

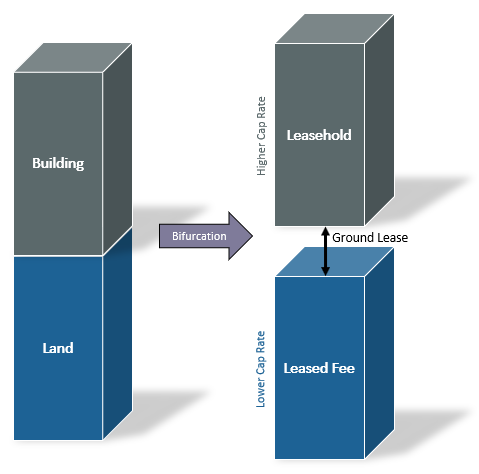

Bifurcation: Creating new leases

The term “real estate” means “property consisting of land and the buildings on it.” A legal process known as “bifurcation” separates the ownership of the two components of real estate, the land and the buildings.

As part of this bifurcation, the new owner of the buildings enters into a ground lease with the owner of the land. The typical ground lease has a term of 99 years and during this term the building owner has the right to use their property as they see fit, including financing it.

Due to the fact that the ground lease is senior to all other payments the land will be valued at lower cap rate than the original “fee simple” property. Similarly, the buildings will be valued at a higher cap rate. This allows the investor to own the same equity upside as the traditional investment but at a higher yield.

How does the financing process work?

New acquisitions

New acquisitions will be bifurcated at time of closing, with the new lease term to begin immediately. You, as the buyer, will enter into a purchase-and-sale agreement as normal. We will then enter into a purchase agreement to buy the land from you; this closing will be simultaneous with the closing of the acquisition from the seller.

During the diligence phase of your acquisition (at the same time you would be making calls to potential lenders) give us a call. We will present you with our proposal for the land and assist you with finding the mortgage for the buildings.

Refinancing

Ground lease financing is a great option for refinancing a property coming off a bridge loan or that has recently seen an appreciation in value. Give us a call and we will work with you to value the land under your property and find a new mortgage for the buildings.

Continue reading to learn more about the various benefits of this approach.